UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(5)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| o | Soliciting Material Pursuant to §240.14a-12 |

ADVANCE AUTO PARTS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | | | | | | | |

| ý | | No fee required. |

| o | | Fee paid previously with preliminary materials. |

| o | | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | | Title of each class of securities to which transaction applies: |

| | (2) | | | Aggregate number of securities to which transaction applies: |

| | (3) | | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | | Proposed maximum aggregate value of transaction: |

| | (5) | | | Total fee paid: |

o | | Fee paid previously with preliminary materials. |

o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | | Amount Previously Paid: |

| | (2) | | | Form, Schedule or Registration Statement No.: |

| | (3) | | | Filing Party: |

| | (4) | | | Date Filed: |

ADVANCE AUTO PARTS, INC.

4200 SIX FORKS ROAD

RALEIGH, NORTH CAROLINA 27609

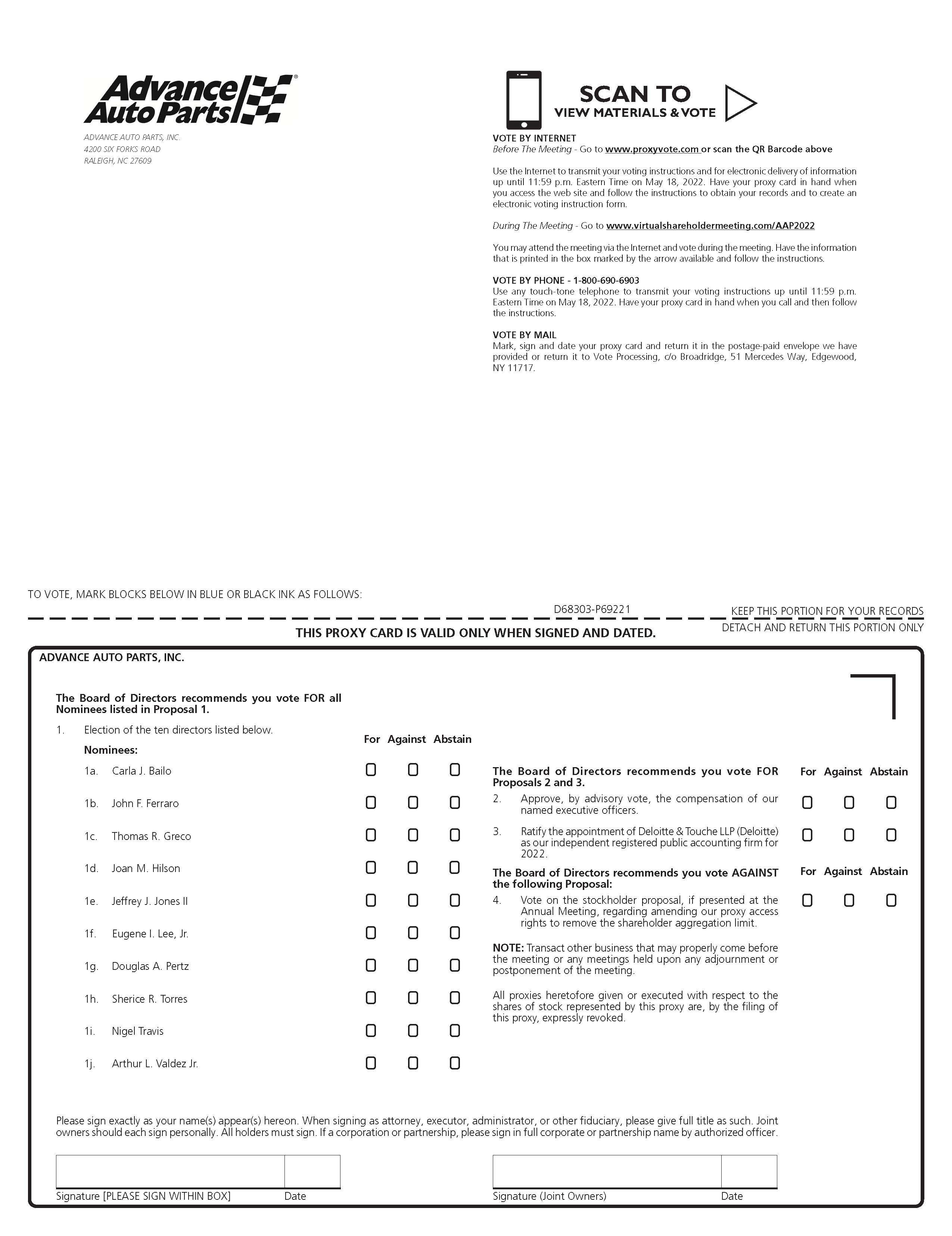

Notice of 20222024 Annual Meeting of Stockholders of

Advance Auto Parts, Inc. (the "Company")

Logistics

| | | | | | | | | | | | | | |

| | | | |

| DATE AND TIME | | PLACE | | PLACE | RECORD DATE |

Thursday,Wednesday, May 19, 2022

22, 2024

at 8:30 a.m. Eastern Time | | www.virtualshareholdermeeting.com/AAP2022

AAP2024. There will be no physical location for this year's meeting. | | Holders of record of our common stock at the close of business on March 24, 2022,25, 2024, are entitled to vote at our Annual Meeting. |

Voting Items

| | | | | | | | | | | |

| | | Board Recommendation |

| 1 | | | Board Recommendation |

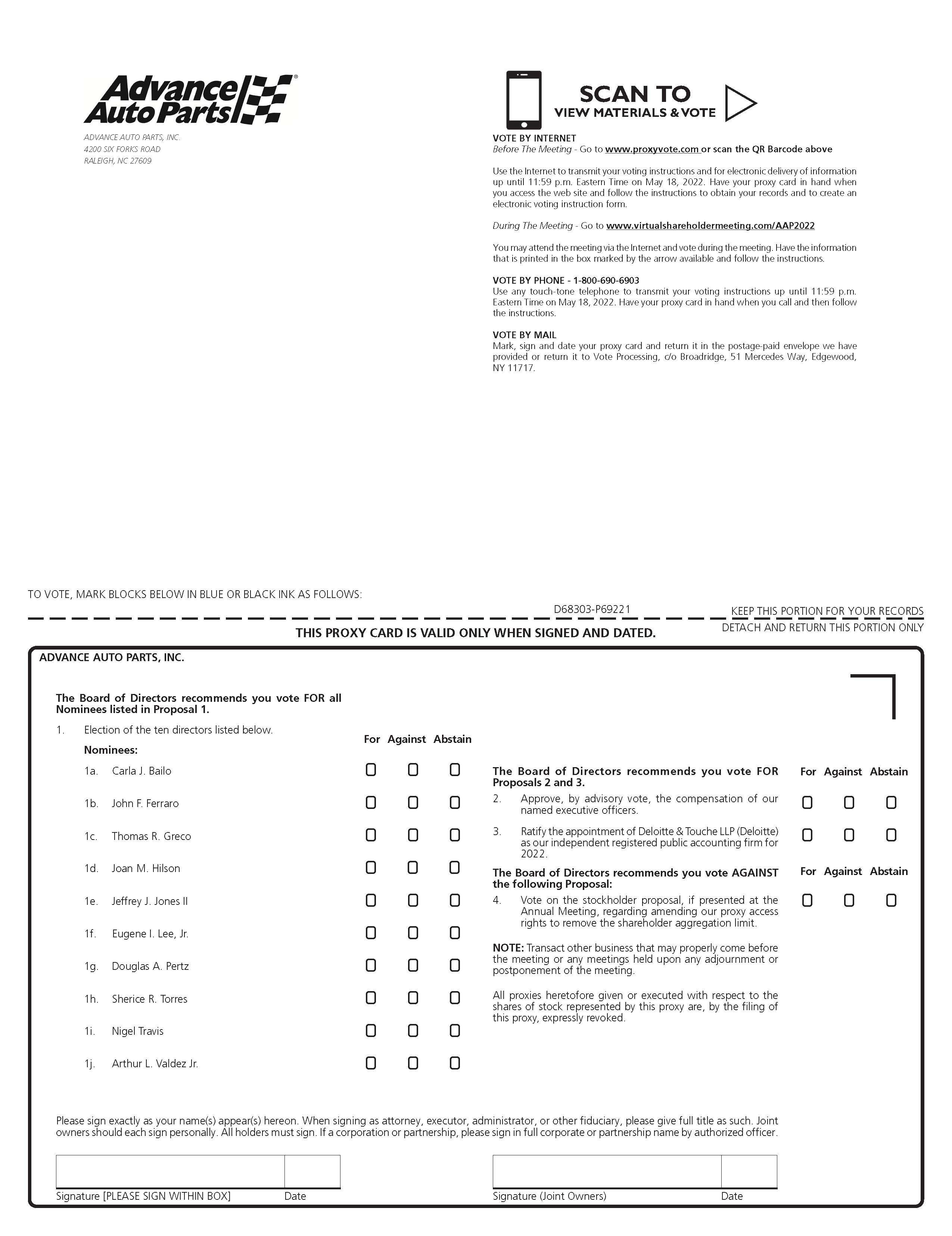

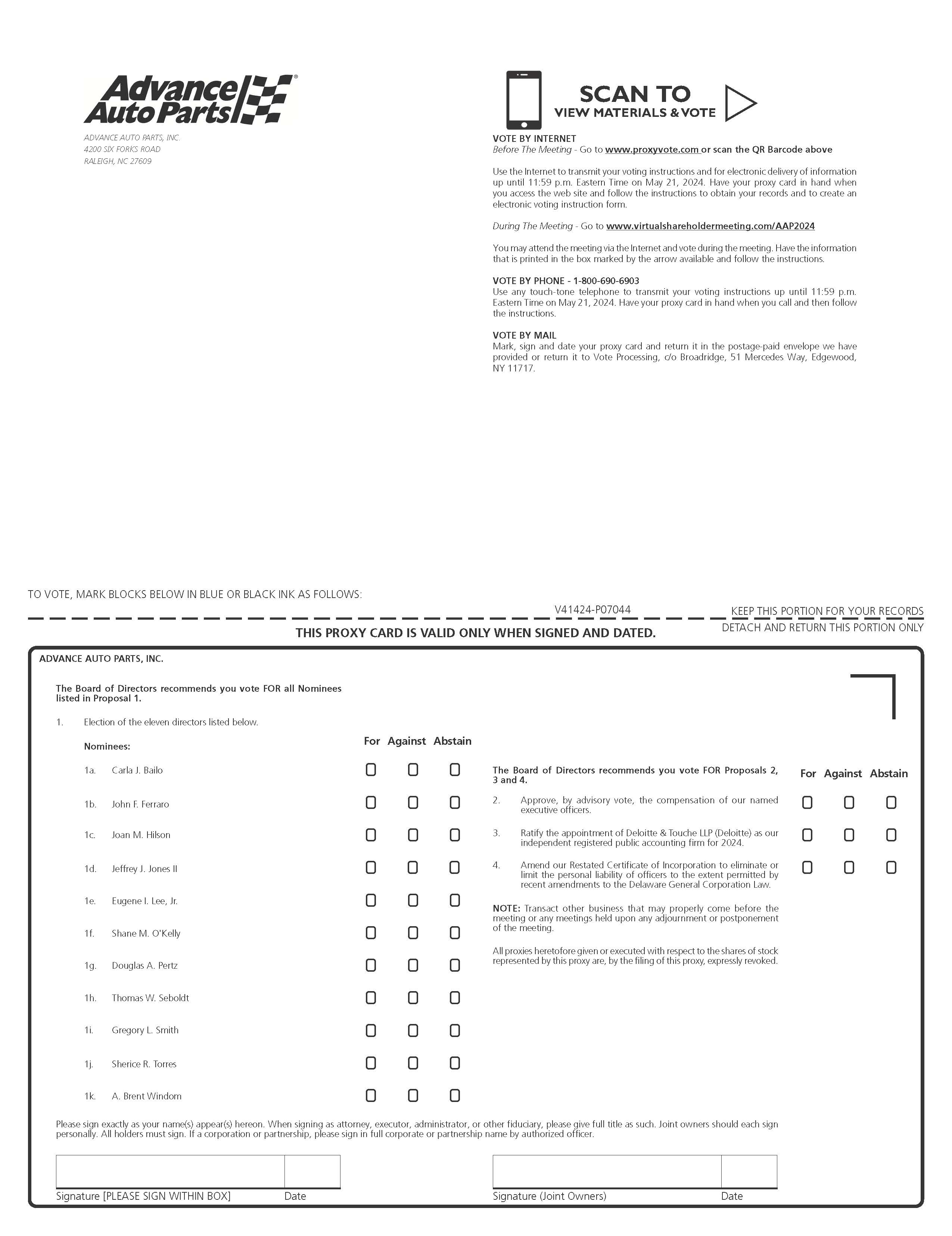

1 | Election of the teneleven nominees named in the Proxy Statement to the Board of Directors ("Board") to serve until the 20232025 annual meeting of stockholders | | FOR each director nominee |

| 2 | Advisory vote to approve the compensation of the Company’s named executive officers | | FOR |

| 3 | Ratification of the appointment by the Audit Committee of Deloitte & Touche LLP ("Deloitte") as the Company’s independent registered public accounting firm for 20222024 | | FOR |

| 4 | ConsiderationAmendment of and vote upon a stockholder proposal, if properly presented at our Annual Meeting, regarding amending proxy access rightsRestated Certificate of Incorporation to removeeliminate or limit the shareholder aggregation limitpersonal liability of officers to the extent permitted by recent amendments to the Delaware General Corporation Law | | AGAINSTFOR |

| 5 | Action upon such other matters, if any, as may properly come before the meeting | | |

Advance Voting Methods

(Your vote must be received by 11:59 p.m. (EDT) on May 18, 2022,21, 2024, the day before the Annual Meeting)

| | | | | | | | |

| | |

INTERNET www.proxyvote.com | TOLL FREE TELEPHONE 1-800-690-6903 | MAIL Complete and sign your proxy card |

We invite you to join our Annual Meeting and vote. We urge you, after reading the attached proxy statement (the "Proxy Statement"), to vote your proxy by Internet or telephone by following the instructions on the form of proxy or by signing and returning the enclosed proxy card in the enclosed postage prepaid envelope as promptly as possible. You may vote live at the virtual meeting even if you previously voted by proxy. If you have a disability, we can provide reasonable assistance to help you participate in the meeting upon request.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held May 19, 2022:22, 2024:

The Notice of 20222024 Annual Stockholders' Meeting and Proxy Statement and the 20212023 Annual Report on Form 10-K,

are available at www.proxyvote.com.

The Notice of Annual Meeting and the accompanying Proxy Statement are being distributed or made available, as the case may be, on or about April 1, 2022.8, 2024.

By order of the Board of Directors,

Tammy Moss Finley

Executive Vice President, General Counsel and Corporate Secretary

Raleigh, North Carolina

April 1, 20228, 2024

Proxy Statement Summary

Voting Roadmap

| | | | | | | | |

| Proposal 1 | | | | | | | | Board Recommendation |

Proposal 1 | Board Recommendation |

| Election of the teneleven nominees named in the Proxy Statement to the Board of Directors ("Board") to serve until the 20232025 annual meeting of stockholders | The Board recommends a vote FOReach director nominee See page 1 |

Director Nominees

| | | | | | | | | | | | | | | | | |

| Name and Age | Director Since | Occupation | Current Committees | Other Current Public Company Boards |

| Carla J. Bailo, 61 63 Independent | 2020 | President and Chief Executive Officer, of The Center for Automotive ResearchECOS Consulting, LLC | Nominating & Corporate Governance

Audit | SM Energy Company Vesuvius plc |

| John F. Ferraro, 66 68 Independent | 2015 | PastFormer Global Chief Operating Officer, Ernst & Young

| Audit (Chair)

| International Flavors & Fragrances Inc.

ManpowerGroup, Inc. |

| Thomas R. Greco, 63Joan M. Hilson, 64

Independent | 20162022 | Chief Financial & Strategy Officer, Signet Jewelers Ltd. | Audit

Finance (Chair) | |

| Jeffrey J. Jones II, 56 Independent | 2019 | President, Chief Executive Officer, H&R Block, Inc. | Compensation (Chair)

Nominating & Corporate Governance | H&R Block, Inc. |

| Eugene I. Lee, Jr., 62 Independent Chair of the Board | 2015 | Former Chairman and Chief Executive Officer, Darden Restaurants, Inc. | Finance | |

| Shane M. O'Kelly, 55 President and Chief Executive Officer | 2023 | President and Chief Executive Officer, Advance Auto Parts, Inc. | | | Tapestry, Inc.

| Joan M. Hilson, 62

Independent

| 2022 | Chief Financial & Strategy Officer, Signet Jewelers Ltd. | | |

| Jeffrey J. Jones II, 54

Independent

| 2019 | President, Chief Executive Officer, H&R Block, Inc. | Compensation (Chair) Nominating & Corporate Governance | H&R Block, Inc. |

| Eugene I. Lee, Jr., 60

Independent Chair of the Board

| 2015 | Chairman and Chief Executive Officer, Darden Restaurants, Inc. | | Darden Restaurants, Inc. |

| Douglas A. Pertz, 6769 Independent | 2018 | Former President and Chief Executive Officer, The Brink's Company | Nominating & Corporate Governance (Chair)

Compensation | The Brink's CompanyVestis Corporation |

| Thomas W. Seboldt, 57 Independent | 2024 | President, Seboldt Consulting Services LLC | Committees not yet assigned | |

| Gregory L. Smith, 60 Independent | 2024 | Executive Vice President, Global Operation and Supply Chain, Medtronic plc | Committees not yet assigned | |

| Sherice R. Torres, 4850 Independent | 2021 | Chief Marketing Officer, Circle Internet Financial, LLCChargePoint, Inc. | Compensation | | Nxt-ID, Inc.

| Nigel Travis, 72A. Brent Windom, 63

Independent | 20182024 | Retired Chief Executive Officer and Former Chairman of the Board, Dunkin' Brands Group, Inc.President, Windom Consulting LLC | Nominating & Corporate Governance (Chair) CompensationCommittees not yet assigned | | Abercrombie & Fitch Co.

| Arthur L. Valdez Jr., 51

Independent

| 2020 | Executive Vice President, Chief Supply Chain & Logistics Officer, Target Corporation | Audit | |

Director Skills, Core Competencies and Characteristics

In 2021,2023, the Nominating and Corporate Governance Committee reviewed the core competencies that it believes should be represented on our Board. The Committee regularly evaluates the composition and diversity of the Board with respect to qualifications and skill sets that are important in consideration of the Company's long termlong-term strategic plan and with respect to providing effective leadership and diverse viewpoints on matters considered by the Board. The following shows certain key skills, competencies and characteristics of our director nominees.

*A-Asian; B-Black or African American; H-Hispanic or Latino; W-White; O-Other

Of the teneleven director nominees that compose our Board:nominees:

| | | | | | | | |

9 10of 1011

are independent | | 4 3of 1011

are diverse with respect to gender (3) or race/ethnicity (2)(1) |

Stockholder Engagement

| | |

Regular Outreach We value dialogue with our stockholders and regularly conduct stockholder governance outreach.outreach in addition to recurring outreach regarding quarterly results and company performance. Feedback from stockholders is shared with the Board and applicable Committees periodically. |

Participants

Outreach Governance outreach discussions with our stockholders generally include our Chief Executive Officer (“CEO”) and management representatives from Investor Relations, Human Resources and the office of the General Counsel and Corporate Secretary.

|

Topics discussed

This year, discussions with stockholders Discussions are primarily focused on Environmental, Socialcorporate governance, executive compensation and Governance (“ESG”) issues and actions,certain business sustainability matters, including our first ESG Materiality Assessment to focus our ESG priorities on topics relevant to our stakeholders that have high potential to contribute value to our business, publication ofdiscussed in our Corporate Sustainability and Social Report, diversity, equityReport. In addition to our governance outreach and inclusionregularly quarterly outreach, we also meet with existing and environmental sustainability,potential investors to discuss the impactcompany's operations and strategy.

|

Recent Engagement In addition to holding regular proactive outreach sessions, throughout the past year we have had additional dialogue with several investors at their request. These discussions have often included, or been conducted directly with, the Chair of the global pandemicBoard, and focused on our businesscompany performance, strategy and our responseleadership of the Company and the Board. As a result of this engagement during 2024, we entered into a Cooperation Agreement with shareholders affiliated with Third Point LLC (together with its affiliates, "Third Point") and Saddle Point Management, L.P. (together with its affiliates, "Saddle Point") pursuant to it, executive compensation matterswhich Messrs. Seboldt, Smith and Windom were appointed the Board composition.and are nominated for election at the Annual Meeting.

|

Corporate Governance Highlights

| | | | | | | | | | | | | | |

| ü | Annual election of all directors | | ü | Strong Guidelines on Significant Governance Issues |

| ü | Directors elected by majority voting | | ü | Annual evaluation of the Board, Committees and individual directors |

| ü | Independent Chair of the Board | | ü | New director searches focused on key skills for the Company's long termlong-term strategic plan and diversity characteristics |

| ü | 90 percentApproximately 91% of our director nominees are independent | | ü | Board policy on CEO succession planning |

| ü | All NYSE required Board committees consist solely of independent directors | | ü | Policies prohibiting hedging and (unless certain stringent requirements are met) prohibiting pledging for all employees and directors |

| ü | Regular executive sessions of independent directors | | ü | ü | Robust stock ownership guidelines for directors and Executive Officers |

| ü | Proxy Access right for up to 20 person groups of stockholders owning 3% of our stock for 3 years to nominate up to 20% of our Board | | ü | ü | Direct oversight by the Nominating and Corporate Governance Committee of ESGdevelopment and communication of business sustainability matters |

| ü | Right for stockholders of 10% or more of the Company's stock to call a special meeting | | ü | ü | Average tenure of 3.43.7 years for our director nominees |

| | | | | | | | |

| Proposal 2 | | | | | | | | Board Recommendation |

Proposal 2 | Board Recommendation |

| Advisory vote to approve the compensation of the Company’s named executive officers. | The Board recommends a vote FOR this Proposal See page 1618 |

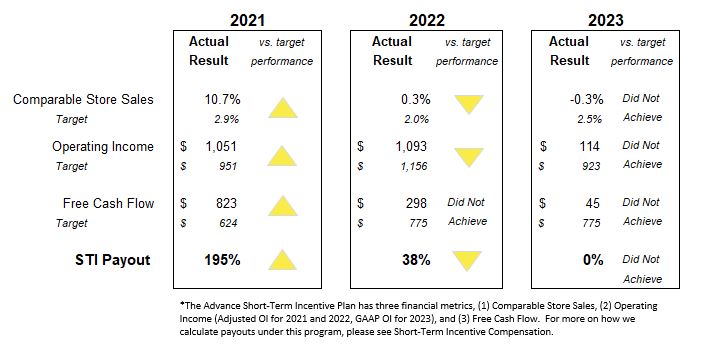

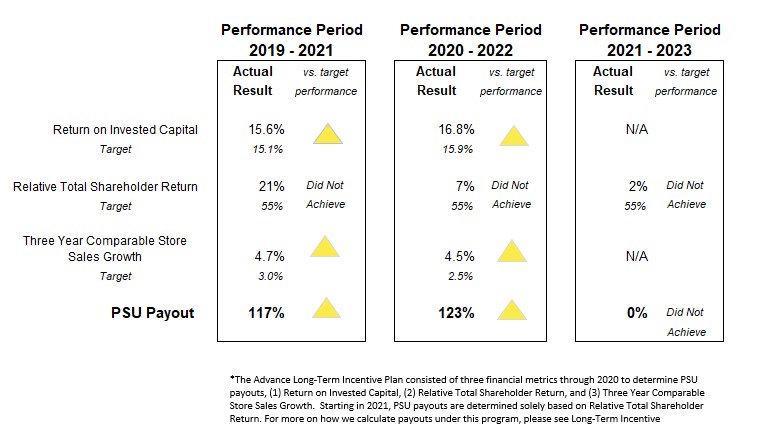

Executive Compensation Highlights

Our compensation programs continue to center on a pay for performance philosophy. Compensation actions in 20212023 were directly aligned with this philosophy to ensure our leadership’s interests are aligned with those of our stockholders. During 2021, we introduced a modifier to our annual incentive plan ("AIP"), which modifies payouts to executives under the AIP by up to +/- 10% based on achievement of individual goals related to diversity, equity and inclusion ("DEI"), to incentivize and rewardAs company performance in a prioritized ESG area; simplified our long term incentive program by moving to a single performance metriclagged, compensation for our performance share units, relative total shareholder return as comparedexecutive officers also significantly declined. Notably for 2023, our executive officers did not receive any payout for short-term incentive awards or any payout for long-term performance-based awards. Furthermore, awards for executives in role transition were thoughtfully designed to the S&P 500 over a three year period, to strengthen the focusprovide market appropriate levels of our executives on delivering our long term of objective of achieving top quartile total shareholder return; and introduced stock options as a component of our long term incentive compensation to more directly align the interests of our executives with those of our stockholders.

Compensation Frameworkcompensation.

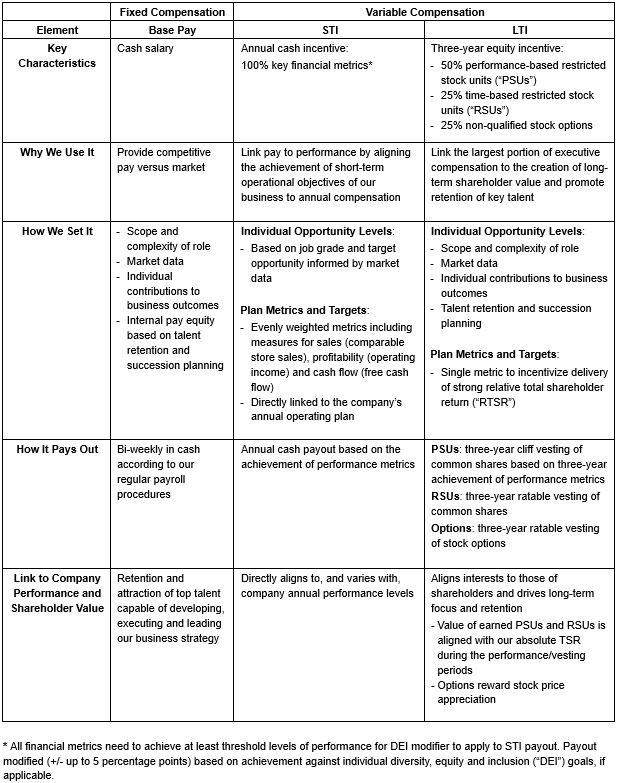

The following table summarizes the compensation elements provided for our Named Executive Officers ("NEOs") in 2021:2023:

| | | | | | | | | | | | | | | | | |

| Element | Purpose | | Metrics |

| Base Salary | Fixed annual cash compensation to attract and retain executives | | Established after review of base salaries of executives of companies in our peer group and the performance of each executive officer |

AnnualShort-Term Incentive

Plan (“AIP” ("STI")(1)

| Performance basedPerformance-based, variable pay that delivers cash incentives when executives meet or exceed key financial and operating targets | | •

•

• | 1/3 Enterprise Comparable Store Sales 1/3Enterprise Adjusted Operating Income 1/3Free Cash Flow PayoutsIf all financial objective thresholds achieved, payouts modified up to +/- 10%5 percentage points based on achievement of individual DEIindividualized, functional diversity, equity and inclusion ("DEI") related goals |

Long TermLong-Term Incentive ("LTI") Equity Compensation | PerformancePerformance- and service basedservice-based equity compensation to reward executives for a balanced combination of meeting or exceeding key financial and operating targets and creating long term stockholderlong-term shareholder value | | 50% Performance based Performance-based Restricted Stock Units ("PSUs") |

| 25% Time based Time-based Restricted Stock Units ("RSUs") |

| 25% Nonqualified stock options |

(1) Enterprise Comparable Stores Sales represents revenue generated by stores, branches and e-commerce in 20212023 relative to the revenue generated by stores, branches and e-commerce in 2020, not2022, including new storeslocations open for 13 complete accounting periods and branches andexcluding sales to independently owned Carquest branded stores. Enterprise Adjusted Operating Income represents the Company’s earnings before interest and taxes, adjusted for non-operational/non-recurring items.locations. Free Cash Flow represents the amount of cash the Company generates from operations less purchases of property and equipment.

20212023 Performance Plan Payouts

| | | | | | | | | | | | | | |

2021 Annual2023 Short-Term Incentive Plan Payout |

| Threshold | ThresholdTarget | TargetMaximum | | Maximum

| Enterprise Operating Income | x | | | 0% |

Enterprise Adjusted Operating Income | | a | | 195% |

| Enterprise Comparable Store Sales | x | | | a

| Free Cash Flow | x | | | a

| | | | | | | | | | | | | | |

2019-2021 Long Term2021-2023 Long-Term Incentive Plan Payout |

| Threshold | ThresholdTarget | TargetMaximum | | Maximum |

Return on Invested Captial ("ROIC") | | a | | 117% |

| Relative Total Shareholder Return | x | | |

Average Annual Comparable Store Sales Growth | | | a0% |

For additional information about 20212023 results achieved and corresponding plan payouts, please see the discussion beginning on page 2019 in Compensation Discussion & Analysis ("CD&A").

Strong Compensation Governance

| | | | | | | | | | | | | | |

| STOCKHOLDER FRIENDLY PRACTICES WE EMPLOY | | STOCKHOLDER UNFRIENDLY PRACTICES WE AVOID |

| ü | Pay for Performance with rigorous objective financial and operational metrics that are closely tied to our success and delivery of stockholder value | | û | Excise tax gross ups for Change in Control payments |

| ü | Incentive Compensation Clawback Policy | | û | Repricing or exchange of underwater stock options |

| ü | “Double Trigger” vesting | | û | Dividends on unearned annual performance basedperformance-based equity awards |

| ü | Robust Stock Ownership Guidelines | | û | Hedging |

| ü | Independence requirements for our Compensation Consultant | | û | Pledging unless certain stringent requirements are met |

For a detailed discussion of our executive compensation program, including the correlation to our comprehensive strategic plan focused on creating long termlong-term stockholder value, please see CD&A beginning on page 16.19.

| | | | | | | | |

| Proposal 3 | | | | | | | | Board Recommendation |

Proposal 3 | Board Recommendation |

| Ratification of the appointment by the Audit Committee of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 20222024 | The Board recommends a vote FOR this Proposal See page 4351 |

| | | | | | | | |

| Proposal 4 | | | | | | | | Board Recommendation |

Proposal 4 | Board Recommendation |

| ConsiderationApproval of and vote upon a stockholder proposal, if properly presented atan amendment to our restated certificate of incorporation to eliminate or limit the Annual Meeting, regarding amending proxy access rightspersonal liability of officers to remove the shareholder aggregation limitextent permitted by recent amendments to the Delaware General Corporation Law | The Board recommends a vote AGAINSTFOR this Proposal See page 4654 |

Table of Contents

| | Proposal No. 1 Election of Directors | Proposal No. 1 Election of Directors | 1 | | | Compensation Committee Report | 27 | | Proposal No. 1 Election of Directors | | | Framework for Executive Compensation | |

| Nominees for Election to Our Board | Nominees for Election to Our Board | 2 | | | Compensation Program Risk Assessment | 28 | | Nominees for Election to Our Board | | | Other Compensation and Benefit Programs | |

| Corporate Governance | Corporate Governance | 7 | | | Additional Information Regarding Executive Compensation | 29 | | Corporate Governance | | | Compensation Committee Report | |

| Overview | Overview | 7 | | | Summary Compensation Table | 29 | | Overview | | | Compensation Program Risk Assessment | |

| Board Composition and Refreshment | Board Composition and Refreshment | 7 | | | Grants of Plan-Based Awards in 2021 | 31 | | Board Composition and Refreshment | | | Additional Information Regarding Executive Compensation | |

| Nominations for Directors | Nominations for Directors | 7 | | | Outstanding Equity Awards at 2021 Fiscal Year End | 32 | | Nominations for Directors | | | Summary Compensation Table | |

| Board Independence and Structure | Board Independence and Structure | 8 | | | Option Exercises and Stock Vested in 2021 | 34 | | Board Independence and Structure | | | Grants of Plan-Based Awards in 2023 | |

| Board's Role in Risk Oversight | Board's Role in Risk Oversight | 10 | | | Non-Qualified Deferred Compensation for 2021 | 34 | | Board's Role in Risk Oversight | | | Outstanding Equity Awards at 2023 Fiscal Year End | |

| Board Evaluation | Board Evaluation | 10 | | | Potential Payments Upon Termination of Employment or Change in Control | 35 | | Board Evaluation | | | Option Exercises and Stock Vested in 2023 | |

| Stockholder and Interested Party Communications with our Board | Stockholder and Interested Party Communications with our Board | 10 | | | CEO Pay Ratio | 37 | | Stockholder and Interested Party Communications with our Board | | | Non-Qualified Deferred Compensation for 2023 | |

| Code of Ethics and Business Conduct | Code of Ethics and Business Conduct | 11 | | | Information Concerning our Executive Officers | 38 | | Code of Ethics and Business Conduct | | | Potential Payments Upon Termination of Employment or Change in Control | |

| Code of Ethics for Finance Professionals | Code of Ethics for Finance Professionals | 11 | | | Security Ownership of Certain Beneficial Owners and Management | 40 | | Code of Ethics for Finance Professionals | | | CEO Pay Ratio | |

| Insider Trading Policy | | Insider Trading Policy | | | Pay Versus Performance | |

| Related Party Transactions | Related Party Transactions | 11 | | | Stock Ownership Guidelines for Directors and Executive Officers | 41 | | Related Party Transactions | | | Information Concerning our Executive Officers | |

| Succession Planning | Succession Planning | 12 | | | Delinquent Section 16(a) Reports | 42 | | Succession Planning | | | Security Ownership of Certain Beneficial Owners and Management | |

| Director Compensation | Director Compensation | 13 | | | Equity Compensation Plan Information | 42 | | Director Compensation | | | Stock Ownership Guidelines for Directors and Executive Officers | |

| 2021 Director Summary Compensation | 13 | | | Proposal No. 3 Ratification of Appointment of Deloitte & Touche LLP as our Independent Registered Public Accounting Firm for 2022 | 43 | |

| Directors' Outstanding Equity Awards at 2021 Fiscal-Year End | 14 | | | 2021 and 2020 Audit Fees | 43 | |

| 2023 Director Summary Compensation | | 2023 Director Summary Compensation | | | Delinquent Section 16(a) Reports | |

| Directors' Outstanding Equity Awards at 2023 Fiscal-Year End | | Directors' Outstanding Equity Awards at 2023 Fiscal-Year End | | | Equity Compensation Plan Information | |

| Proposal No. 2 Stockholder Advisory Vote to Approve the Compensation of the Company's Named Executive Officers | Proposal No. 2 Stockholder Advisory Vote to Approve the Compensation of the Company's Named Executive Officers | 15 | | | Audit Committee Report | 44 | | Proposal No. 2 Stockholder Advisory Vote to Approve the Compensation of the Company's Named Executive Officers | | | Proposal No. 3 Ratification of Appointment of Deloitte & Touche LLP as our Independent Registered Public Accounting Firm for 2024 | |

| Compensation Discussion and Analysis | Compensation Discussion and Analysis | 16 | | | Proposal No. 4 Stockholder Proposal Entitled "Proxy Access" | 45 | | Compensation Discussion and Analysis | | | Proposal No. 4 Approval of Amendment to Our Restated Certificate of Incorporation to Eliminate or Limit the Personal Liability of Officers to the Fullest Extent Permitted by the Delaware General Corporation Law | |

| Executive Summary | Executive Summary | 16 | | | Board of Directors' Statement in Opposition to Proposal No. 4 | 46 | | Executive Summary | | | Other Matters | |

| Compensation Governance | Compensation Governance | 18 | | | Other Matters | 49 | | Compensation Governance | | | Appendix A - Amendment to Restated Certificate of Incorporation | A-1 |

| Framework for Executive Compensation | 21 | | | |

| Other Compensation and Benefit Programs | 25 | | | |

Note: Unless otherwise indicated in the text, any reference to a year is intended to refer to the Company’s fiscal year of the same date as described in the Company’s 20212023 Annual Report on Form 10-K filed with the Securities and Exchange Commission ("SEC") on February 15, 2022March 12, 2024 (the "2021"2023 Form 10-K").

Proposal No. 1

Election of Directors

At the 20222024 annual meeting of stockholders (the "Annual Meeting"), you will vote to elect as directors the teneleven nominees listed below to serve until our 20232025 annual meeting of stockholders or until their respective successors are elected and qualified. Our Board has nominated Carla J. Bailo, John F. Ferraro, Thomas R. Greco, Joan M. Hilson, Jeffrey J. Jones II, Eugene I. Lee, Jr., Shane M. O'Kelly, Douglas A. Pertz, Thomas W. Seboldt, Gregory L. Smith, Sherice R. Torres Nigel Travis and Arthur L. Valdez Jr.A. Brent Windom for election as directors. All of the nominees are current members of our Board. Each nominee has consented to being named in this Proxy Statement as a nominee and has agreed to serve as a director if elected. None of the nominees to our Board has any family relationship with any other nominee or with any of our executive officers. The Board does not currently have any vacancies.

The persons named as proxies in the accompanying form of proxy have advised us that at the Annual Meeting, unless otherwise directed, they intend to vote the shares covered by the proxies FOR the election of the nominees named above. If one or more of the nominees are unable to serve, or will not serve, the persons named as proxies may vote for the election of any substitute nominees that our Board may propose. The persons named as proxies may not vote for a greater number of persons than the number of nominees named above. Our by-laws provide that a nominee for director in an uncontested election must receive a majority of the votes cast at the Annual Meeting for the election of that director in order to be elected. If a nominee for director who is an incumbent director is not elected and no successor has been elected at the Annual Meeting, the director is expected to tender his or her resignation from the Board contingent on acceptance of such resignation by the Board.

Nominees for Election to Our Board

The following information is provided about our nominees for director effective as of the record date, March 24, 202225, 2024 (the "Record Date").

CARLA J. BAILOIndependent

President and Chief Executive Officer, The Center for Automotive ResearchECOS Consulting, LLC | | | | | |

Age: Age: 61 63Director Since: August 2020 Committee: Audit; Nominating and Corporate Governance Other Current Public Company Boards: SM Energy Company Vesuvius plc | Key Experience and Skills With an accomplished career in the automotive industry, including several leadership roles in both corporate and academic settings, Ms. Bailo brings a unique and valuable point of view to our Board. She also has significant experience in the environmental sustainability space and brings a differentiated perspective on ESGbusiness sustainability matters to our Board. She has been designated by the Board as an audit committee financial expert consistent with SEC regulations.

Professional Experience Ms. Bailo is currently the President and Chief Executive Officer of ECOS Consulting, LLC, an energy efficiency solutions provider, a position she has held since 2014. Ms. Bailo also served as the President and Chief Executive Officer of The Center for Automotive Research, an independent, non-profit research organization that engages with leaders in the global automotive industry to support technology advancements and improve the competitiveness of the U.S. automotive industry, a position she has held sincefrom October 2017. Ms. Bailo has also been President and Chief Executive Officer of ECOS Consulting, LLC, an energy efficiency solutions provider, since 2014.2017 to September 2022. Previously, Ms. Bailo served as Assistant Vice President, Mobility Research and Business Development of The Ohio State University, a public research university, from 2015 to October 2017. Prior to 2015, Ms. Bailo held various leadership roles with Nissan Motor Co. Ltd., a multinational automobile manufacturer, and began her career with General Motors Company, a multinational vehicle and financial services corporation. Ms. Bailo has served on the board of directors for SM Energy Company, a company engaged in hydrocarbon exploration, since October 2018.2018, and on the board of directors for Vesuvius plc, an international ceramics company, since February 2023. |

JOHN F. FERRAROIndependent

PastFormer Global Chief Operating Officer, Ernst & Young | | | | | |

Age: 66 68 Director Since: February 2015 Committee: Audit (Chair) Other Current Public Company Boards: International Flavors & Fragrances Inc. ManpowerGroup Inc. | Key Experience and Skills Mr. Ferraro has extensive financial, corporate management, governance and public policy experience which enables him to assist the Board in identifying trends and developments that affect public companies. In addition, the Board benefits from his experience in the areas of marketing and the development of corporate strategy. He has been designated by the Board as an audit committee financial expert consistent with SEC regulations.

Professional Experience Mr. Ferraro served as our independent Lead Director from November 2015 to May 2016. Mr. Ferraro founded RP Intellectual Partners LLC, a successor to a part of Alpha Alpha Intellectual Partners LLC, in November 2022. He also served as Executive Vice President, Strategy and Sales of Aquilon Energy Services, a software and services company for the energy industry from February 2019 to July 2019. He served as Global Chief Operating Officer ("COO") of Ernst & Young ("EY"), a leading professional services firm, from 2007 to December 2014 and retired as a partner of EY at the end of January 2015. In addition, Mr. Ferraro served as a member of EY’s Global Executive Board for more than 10 years. Mr. Ferraro joined EY in 1976 and prior to his COO role he served in several senior leadership positions at EY, including Global Vice Chair Audit. Mr. Ferraro practiced as a Certified Public Accountant for 35 years. Mr. Ferraro has served as a director for ManpowerGroup Inc., a provider of workforce solutions, since January 2016, and for International Flavors & Fragrances Inc., a manufacturer of flavors and fragrances, since May 2015. |

THOMAS R. GRECO

President and Chief Executive Officer, Advance Auto Parts, Inc. | | | | | |

Age: 63

Director Since:

April 2016

Committee:

None

Other Current Public Company Boards:

Tapestry, Inc.

| Key Experience and Skills

Mr. Greco has served as our President and Chief Executive Officer and a member of our Board since 2016. Previously, Mr. Greco was the Chief Executive Officer of Frito-Lay North America, where he worked to grow revenue and increase profits, providing him with important experience in the consumer retail industry. Mr. Greco brings to the Board significant experience and leadership in the areas of corporate strategy, marketing, supply chain and logistics.

Professional Experience

Mr. Greco became our President and Chief Executive Officer in August 2016, having served as Chief Executive Officer since April 2016. From September 2014 until April 2016, Mr. Greco served as Chief Executive Officer, Frito-Lay North America, a unit of PepsiCo, Inc. (“PepsiCo”), a leading global food and beverage company. As Chief Executive Officer, Frito-Lay North America, Mr. Greco was responsible for overseeing PepsiCo’s snack and convenient foods business in the U.S. and Canada. Mr. Greco previously served as Executive Vice President, PepsiCo and President, Frito-Lay North America from September 2011 until September 2014 and as Executive Vice President and Chief Commercial Officer for Pepsi Beverages Company from 2009 to September 2011. Mr. Greco joined PepsiCo in Canada in 1986 and served in a variety of leadership positions, including Region Vice President, Midwest; President, Frito-Lay Canada; Senior Vice President, Sales, Frito-Lay North America; President, Global Sales, PepsiCo; and Executive Vice President, Sales, North America Beverages. Before joining PepsiCo, Mr. Greco worked at The Proctor & Gamble Company, a consumer packaged goods company. He has served as a director of Tapestry, Inc., an American multinational luxury fashion holding company, since December 2020.

|

| |

JOAN M. HILSONIndependent

Chief Financial & Strategy Officer, Signet Jewelers Ltd. | | | | | |

Age: 62 64 Director Since: March 2022 Committees: NoneAudit Finance (Chair)

Other Current Public Company Boards: None

| Key Experience and Skills Ms. Hilson brings more than 35 years of finance experience and deep specialty retail experience to our Board. In her role as Chief Financial & Strategy Officer of Signet Jewelers, she has strong experience withbeen integral to leading transformation on a strategy intended to drive profitable growth through innovation, capital management, real estate optimization and expansion of market share, which brings valuable perspective to our Board. She has been designated by the Board as an audit committee financial expert consistent with SEC regulations.

Professional Experience Ms. Hilson has served as Chief Financial & Strategy Officer of Signet Jewelers, Ltd., the world's largest retailer of diamond jewelry, since March 2021, and she has served as Signet's Chief Financial Officer since April 2019. Prior to joining Signet, Ms. Hilson served as Chief Financial Officer of David’s Bridal Inc., a large specialty clothing retailer from 2014 to 2019; Executive Vice President and Chief Financial Officer and other executive financial leadership roles at American Eagle Outfitters, Inc., a lifestyle, clothing and accessories retailer from 2005 to 2012; and in several financial reporting, financial planning and merchandise planning positions at Limited Brands, Inc., a specialty retailer, including as Executive Vice President and Chief Financial Officer for Victoria’s Secret Stores division. Ms. Hilson served as the Controller of Sterling Jewelers (now Signet Jewelers) from 1985 to 1992. She began her career as an auditor at Coopers & Lybrand LLP, one of the oldest professional financial and consulting services firms in the United States (which subsequently merged with PricewaterhouseCoopers). |

JEFFREY J. JONES IIIndependent

President and Chief Executive Officer, H&R Block, Inc. | | | | | |

Age: 54 56 Director Since: February 2019 Committees: Compensation (Chair); Nominating and Corporate Governance Other Current Public Company Boards: H&R Block, Inc.

| Key Experience and Skills Mr. Jones brings to the Board nearlyover 30 years of executive management, innovative leadership and operational excellence experience while holding key roles with top companies in the retail, consumer products, agency and technology industries,industries. He has served as President and Chief Executive Officer of a leading tax services provider for nearly a decade, where he has had substantial experience with launching initiatives to drive traffic, brand affinity and loyalty. HisAdditionally, his position as a director of another public company also enables him to share with the Board his experience with governance issues facing public companies.

Professional Experience Mr. Jones is currently President and Chief Executive Officer of H&R Block, Inc., a global consumer tax services provider, a position he has held since October 2017. Prior to October 2017, Mr. Jones served as H&R Block’s President and Chief Executive Officer-Designate beginning in August 2017. Previously, Mr. Jones served as President, Ride Sharing at Uber Technologies Inc., an on-demand car service company, from September 2016 until March 2017 and Executive Vice President and Chief Marketing Officer at Target Corporation, a retail sales company, from April 2012 to September 2016. Prior to his time at Target Corporation, Mr. Jones held various executive and leadership roles related to sales, agency and marketing with iconic brands such as The Coca-Cola Company and The Gap, Inc. He has served as a director of H&R Block, Inc. since 2017. |

EUGENE I. LEE, JR.Independent (Chair of the Board)

Former Chairman and Chief Executive Officer, Darden Restaurants, Inc. | | | | | |

Age: 60 62 Director Since: November 2015 Committee: NoneFinance

Other Current Public Company Boards: Darden Restaurants, Inc.None

| Key Experience and Skills Mr. Lee’s prior experience as the ChiefExecutive Officer of a national group of chain restaurants provides him with strong insights into customer service and the types of management issues that face companies with large numbers of employees in numerous locations throughout the country. In addition, he brings experience in marketing, real estate, strategic planning and change management. His long tenured service on the boards of directors of RARE Hospitality International, Inc. and Darden Restaurants, Inc., as well as his temporary service as Interim Executive Chair of the Advance Auto Parts Board, have deepened his governance expertise and board leadership experience.

Professional Experience Mr. Lee is currently serving, and until May 29, 2022, will continue to serve,served as the ChairmanPresident and Chief Executive Officer of Darden Restaurants, Inc. ("Darden"(“Darden”), the owner and operator of Olive Garden, LongHorn Steakhouse, Bahama Breeze, Cheddar'sCheddar’s Scratch Kitchen, Seasons 52, The Capital Grille, Eddie V’s and Yard House restaurants in North America, positions he has held sincefrom February 2015 through January 2021. On May 29, 2022, Mr. Lee will be retiring as Chief Executive Officer but will continue to serve on the Darden Board of Directors in a non-executive capacity. Previously, Mr. Lee served as Darden’s President and Chief Executive Officer from February 2015 to January 2021, President and Interim Chief Executive Officer from October 2014 to February 2015, and President and Chief Operating Officer from September 2013 to October 2014. He served as President of Darden’s Specialty Restaurant Group from October 2007 to September 2013 following Darden’s acquisition of RARE Hospitality International, Inc., where he had served as President and a member of the Board of Directors since 2001. Mr. Lee has served as a member of the Darden Board of Directors sincefrom February 2015.2015 through September 2023. |

SHANE M. O'KELLY

President and Chief Executive Officer, Advance Auto Parts, Inc. | | | | | |

Age: 55 Director Since: September 2023 Committee: None Other Current Public Company Boards: None | Key Experience and Skills Mr. O'Kelly has served as our President and Chief Executive Officer and a member of our Board since 2023. Previously, Mr. O'Kelly was the Chief Executive Officer of HD Supply, Inc. ("HD Supply") where he improved operational execution, oversaw the transition of a distribution center network and delivered record sales and profit numbers. Mr. O'Kelly brings to the Board significant experience and leadership in the areas of general management, retail operations and strategic planning.

Professional Experience Mr. O’Kelly joined Advance Auto Parts as President and Chief Executive Officer in September 2023. Prior to joining Advance, Mr. O’Kelly served as the Chief Executive Officer of of HD Supply, a national distributor and provider of maintenance, repair and operations (“MRO”) products and a wholly-owned subsidiary of The Home Depot, Inc. (the “Home Depot”), a leading home improvement retailer, from December 2020 to September 2023. From March 2018 through December 2020, Mr. O’Kelly served as Chief Executive Officer of Interline Brands, Inc., a leading national distributor and marketer of MRO products that was merged into Home Depot in December 2020. He previously served as Chief Executive Officer of PetroChoice Holdings, Inc., a leading national lubricant distributor, from June 2011 to March 2018, and as Chief Executive Officer of AH Harris & Sons, Inc., a specialty construction supply distributor, from January 2008 to June 2011. Mr. O’Kelly formerly served as a Captain in the U.S. Army. |

| |

DOUGLAS A. PERTZIndependent

Former President and Chief Executive Officer, The Brink's Company | | | | | |

Age: 67 69 Director Since: May 2018 Committee: Compensation; Nominating and Corporate Governance(Chair) Compensation

Other Current Public Company Boards: The Brink's CompanyVestis Corporation

| Key Experience and Skills Mr. Pertz has led several global companies as Chief Executive Officer over the past 20 years and throughout his career has guided multinational organizations through both operational turnaround and growth acceleration. Mr. Pertz’s leadership positions have honed his operational expertise in branch and route-based logistics, business-to-business services, channel and brand marketing and growth through acquisition.

Professional Experience Mr. Pertz is currently, and through May 6, 2022 will be, theserved as President and Chief Executive Officer of The Brink’s Company (“Brink’s”), the world’s largest cash management company including cash-in-transit, ATM services, international transportation of valuables, cash management and payment services. He has held these positions sinceservices, from June 2016. On2016 through May 6, 2022, Mr. Pertz will transition to executive chairman of the board of Brink's.2022. Prior to joining Brink’s, Mr. Pertz was the Presidentpresident and Chief Executive OfficerCEO of Recall Holdings Limited (“Recall”), a global provider of digital and physical information management and security services, from 2013 to 2016. Prior to joining Recall,Previously, Mr. Pertz served as a partner with Bolder Capital, LLC, a private equity firm specializing in acquisitions and investments in middle market companies and as a partner with One Equity Partners, the private equity arm of JPMorgan Chase & Co. He also served as Chief Executive Officer and on the Board of Directors ofseveral other public companies, including IMC Global, the predecessor company to The Mosaic Company, a mining and production company, and Culligan Water Technologies, and Clipper Windpower, and asInc., a Group Executive and Corporate Vice President at Danaher Corporation.water systems treatment company. Mr. Pertz has servedcurrently serves on the board of directors for Vestis as Vice Chairman. Mr. Pertz was a member of Brink’s Boardthe Brink's board of Directors sincedirectors from June 2016 and in the pastto May 2023, including serving as Executive Chairman from May 2022 to May 2023. Additionally, Mr. Pertz has served on the board of directors of numerous other public companies, including Recall, Nalco Holdings, The Mosaic Company, IMC Global and Bowater. |

THOMAS W. SEBOLDTIndependent

President, Seboldt Consulting Services LLC | | | | | |

Age: 57 Director Since: March 2024 Committee: Not yet assigned Other Current Public Company Boards: None | Key Experience and Skills Mr. Seboldt has over three decades of service in the automotive industry. In particular, his deep experience in merchandising at O'Reilly Automotive, Inc. brings key experience in a focus area for the Company. He has also served in leadership roles on several prominent industry associations, which provides the Board with valuable insights on matters of particular importance in the aftermarket automotive industry.

Professional Experience Mr. Seboldt is a seasoned executive in the automotive retail industry with over three decades of industry experience. Mr. Seboldt has been the President of Seboldt Consulting Services LLC, an automotive industry consulting firm, since January 2019. Previously, Mr. Seboldt spent the vast majority of his career with O’Reilly Automotive, Inc., an American auto parts retailer, from 1987 until November 2018, where he held several titles of increasing responsibility, including Vice President, Merchandising. Mr. Seboldt has also served on the board of prominent industry associations including the California Automotive Wholesalers’ Association (“CAWA”) and the Auto Care Association. During his tenure on the CAWA Board, Mr. Seboldt has served in a variety of positions, including President, Vice President, Executive Committee member and Treasurer. |

GREGORY L. SMITHIndependent

Executive Vice President, Global Operations and Supply Chain, Medtronic plc | | | | | |

Age: 60 Director Since: March 2024 Committee: Not yet assigned Other Current Public Company Boards: None | Key Experience and Skills Mr. Smith brings deep expertise in supply chain to the Board, providing valuable insights in a key area of focus for the Company. His executive experience in multinational retail organizations, including organizations that serve both consumers and other businesses, brings valuable perspective to the Board.

Professional Experience Mr. Smith is a proven supply chain expert with nearly 40 years of experience across a variety of industries. Mr. Smith currently serves as Executive Vice President, Global Operation and Supply Chain of Medtronic plc, a leading global healthcare technology company. Prior to joining Medtronic in 2021, Mr. Smith was Executive Vice President, Supply Chain of Walmart Inc., a multinational omni-channel retail corporation, from 2017 to 2021 and Senior Vice President, Global Operations of The Goodyear Tire and Rubber Company, a multinational tire manufacturer, from 2011 to 2016. Earlier in his career, Mr. Smith spent a decade with Conagra Foods, Inc., a consumer packaged goods company, where he served in several leadership positions, including Executive Vice President, Supply Chain. He previously held roles with United Signature Foods LLC and Aurora Foods Inc. |

SHERICE R. TORRESIndependent

Chief Marketing Officer, Circle Internet Financial, LLCChargePoint, Inc. | | | | | |

Age: 48 50 Director Since: September 2021 Committee: Compensation Other Current Public Company Boards: Nxt-ID, Inc.None

| Key Experience and Skills Ms. Torres has nearly 25 years of executive management experience with top companies in marketing, brand management, strategic planning and social responsibility. This deep experience in digital marketing is complemented by her experience with and commitment to enhancing diversity, equity and inclusion.

Professional Ms. Torres has served as the Chief Marketing Officer of ChargePoint, Inc., a leading provider of networked hardware and software solutions for charging electric vehicles, since August 2023. Previously, Ms. Torres served as Chief Marketing Officer of Circle Internet Financial, LLC, a global internet finance firm, sincefrom January 2022.2022 to August 2023. From November 2020 until January 2022, she served as Vice President,Chief Marketing at F2 - Facebook Financial,Officer of Novi, a division of Facebook, Inc. (now Meta),Meta, a leading technology company, where she led all aspects of global marketing across Facebook's payment products. From August 2014 to May 2020, Ms. Torres served as Global Marketing Director for Google, Inc., a leading technology company, and from May 2020 to October 2020, she served as Global Inclusion Director for Google. Prior to 2014, Ms. Torres served in a variety of leadership roles at Viacom (now ViacomCBS Inc.)Paramount), a media and entertainment company, across consumer products, strategic planning and digital. She began her career in the change management consulting practice of Deloitte Touche Tohmatsu Limited, a multinational professional services provider. Ms. Torres also servesserved on the board of directors of Nxt-ID, Inc.,LogicMark, LLC, a publicly traded software company.seller of medical alert devices, from February 2022 to March 2023.

|

A. BRENT WINDOMIndependent

NIGEL TRAVISIndependent

Former Chairman of the Board and Retired Chief Executive Officer, Dunkin' Brands Group, Inc.President, Windom Consulting LLC | | | | | |

Age: 72 63 Director Since: August 2018March 2024

Committee: Nominating and Corporate Governance (Chair); Compensation

Other Current Public Company Boards:

Abercrombie & Fitch Co.

| Key Experience and Skills

Mr. Travis's experience in executive leadership roles at several global companies within the retail and restaurant industries, including his experience as an architect of the turnaround of Dunkin' Brands provides the Board with valuable insights for the Company's continued transformation. In addition, as a result of his service as a director of several other public companies, he is in an excellent position to share with the Board his experience with governance issues facing public companies.

Professional Experience

Mr. Travis served as the Executive Chairman of the Board for Dunkin’ Brands Group, Inc., a quick-service restaurant franchisor, from July 2018 to January 2019 when he transitioned to Chairman until December 2020. Previously, he served as Chief Executive Officer of Dunkin’ Brands from January 2009 to July 2018, where he assumed the additional responsibility of Chairman of the Board in May 2013. Mr. Travis has also served in executive leadership roles at various companies within the retail and restaurant industries. He has served as a director of Abercrombie & Fitch Co., a global multi-brand specialty retailer, since January 2019 and formerly served as a director of Office Depot, Inc., an office supply company, from March 2012 to May 2020.

|

ARTHUR L. VALDEZ JR.Independent

Executive Vice President, Chief Supply Chain & Logistics Officer, Target Corporation | | | | | |

Age: 51

Director Since:

August 2020

Committee:

AuditNot yet assigned

Other Current Public Company Boards: None | Key Experience and Skills Mr. Valdez'sWindom's deep automotive industry experience, including service as chief executive experienceofficer at multiple organizations, provides the Board with valuable insightsinsights. Mr. Window's expertise in a key component ofoperations, particularly in the Company's continued transformation. In particular, Mr. Valdez's deep experience with supply chain throughout its growth at Amazon and his leadership of global supply chain and logistics for Targetautomotive aftermarket, provide highly relevant subject matter expertise. Additionally, the Board believes that Mr. ValdezHe also brings important diversity of thought and experience in Canadian operations to the Board that is particularly relevant to retailers serving a broad array of consumers.Board.

Professional Experience Mr. ValdezWindom, 63, is currentlyan experienced automotive industry executive, having spent nearly four decades working in roles across the sector. Most recently, Mr. Windom has served as the President of Windom Consulting LLC, an executive consulting services business, since July 2021. From May 2019 to June 2021, Mr. Windom served as President and Chief Executive Vice President, Chief Supply Chain & Logistics Officer of Target Corporation,Uni-Select Inc., a retail corporation,leading automotive refinish, industrial coatings and automotive aftermarket parts distributor. Previously, Mr. Windom was President and COO of Canadian Automotive Group, Uni-Select’s Canadian business, from July 2017 to May 2019. Mr. Windom also served as president and Chief Executive Officer of Auto Plus | Pep Boys, a position he has held since Marchmajor U.S.-based distributor of automotive aftermarket parts and an aftermarket retailer, from February 2016 until July 2017, which was formed following Icahn Enterprises L.P.’s acquisition of Uni-Select USA, Inc. and Beck/Arnley Worldparts, Inc. Prior to joining IEH Auto Parts, Mr. Windom spent 10 years with Uni-Select, where he leads all functionsheld positions of Target’s global supply chainincreasing responsibility including President and logistics network. Mr. Valdez has spent his career building supply chain and fulfillment networks across Asia, Europe and North and South America. Prior to his time at Target Corporation, Mr. Valdez spent 17 years in a variety of leadership roles with Amazon.com Inc., an online retailer, including Vice President, Operations, International Expansion, Vice President, Worldwide Transportation, and Vice President, Operations, Amazon.co.uk Ltd.Chief Operating Officer, Uni-Select USA.

|

| | | | | |

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACH OF OUR BOARD NOMINEES. |

Corporate Governance

Overview

We believe that our strong corporate governance practices reflect our values and support our strategic and financial performance. The compass of our corporate governance practices can be found in our by-laws, our Guidelines on Significant Governance Issues and our Code of Ethics and Business Conduct, which were adopted by our Board to guide our Company, our Board and our employees (“team members”associates”) and are available on our website at ir.advanceautoparts.com under "Governance." Each standing committee of the Board has a charter, available at ir.advanceautoparts.com under "Governance," that spells out the roles and responsibilities assigned to it by the Board. In addition, the Board has established policies and procedures that address matters such as risk oversight, stockholder and interested party communications with the Board, transactions with related persons, insider trading, executive officer succession planning and other matters. For additional information about corporate governance highlights, please see "Proxy Summary - Corporate Governance Highlights."

Board Composition and Refreshment

Of the teneleven director nominees that compose our Board:

| | | | | | | | |

9 10of 1011

are independent | | 4 3of 1011

are diverse with respect to gender (3) or race/ethnicity (2)(1) |

Our directors possess a breadth of skills and depth of experience relevant to being able to provide effective oversight for the execution of the Company's transformation agenda and creation of long termlong-term value. For additional information about the skills, experiences and characteristics of our Board, please see "Proxy Summary - Director Skills, Core Competencies and Characteristics."

We believe the Board benefits from a balance of newer directors, who bring fresh perspectives, and longer serving directors, who have contributed to our strategy over time and have deep understanding of our operations. We continually assess the composition of the Board, including the Board's size and the diversity, skills and experience of our directors, to ensure continued alignment with the strategic direction of the Company.

As part of this evaluation during 2021, In 2024, in connection with engagement with shareholders Third Point and Saddle Point, the Nominating and Corporate Governance Committee identified digital expertise, current financial executive experience and gender and racial/ethnic diversity as areas it would like to augment on the Board. Using a third party search firm, the Committee identified and evaluated several excellent candidates, ultimately recommendingBoard added three new directors to the Board the appointment of Mses. Torreswith deep industry and Hilson.operational expertise. The Board does not currently have any vacancies.

| | | | | | | | |

4 6new directors

have joined our Board in the past 3 years | | 3.4 3.7years

average tenure of our director nominees |

Nominations for Directors

Identifying Director Candidates

The Nominating and Corporate Governance Committee is responsible for leading the search for and evaluating qualified individuals, including those of diverse backgrounds, to become nominees for election as directors. The Committee is authorized to retain a search firm to assist in identifying, screening and attracting director candidates. After a director candidate has been identified, the Committee evaluates each candidate for director within the context of the needs of the Board in its composition as a whole. The Committee considers such factors as the candidate’s business experience, skills, independence, judgment, diversity and ability and willingness to commit sufficient time and attention to the activities of the Board. At a minimum, recommended candidates for nomination must possess the highest personal and professional ethics, integrity and values, and commit to representing the long termlong-term interests of our stockholders. Although the Board has not adopted a formal policy with regard to diversity (including, but not limited to, with respect to gender, race, ethnicity, sexual orientation, disability and age) in the composition of the Board, the Committee is committed to considering candidates of diverse backgrounds in every director search it leads and strives to compose a Board that reflects diverse viewpoints that will actively and constructively contribute to the Board’s discourse and deliberations.

2024 Cooperation Agreement

On March 11, 2024, we entered into the Cooperation Agreement with shareholders affiliated with Third Point and Saddle Point (collectively, the "Investor Group"). Pursuant to the Cooperation Agreement, and upon the recommendation of the Nominating and Corporate Governance Committee, the Board appointed each of A. Brent Windom, Gregory L. Smith and Thomas W. Seboldt (the "New Directors") as new independent members of the Board, effective March 11, 2024 and agreed to nominate each of the New Directors to stand for election at the Annual Meeting.

Pursuant to the Cooperation Agreement, the Investor Group has agreed to abide by certain standstill restrictions and voting commitments. The Cooperating Agreement also includes procedures regarding the replacement of any of the New Directors, a mutual non-disparagement provision and provisions permitting the Investor Group to meet periodically with the Board (once annually) and management (quarterly).

The Investor Group's right to participate in the selection of the replacement New Directors, the Company's obligations with respect to the appointment of such replacement New Directors, and the Investor Group's meeting rights with the Board and management are subject to the Investor Group beneficially owning a "net long position" of, or having aggregate net long exposure to, at least 50% of their "net long position" as of the date of the Cooperation Agreement. Certain provisions of the Cooperation Agreement, including the standstill and mutual non-disparagement provisions, will remain effective until the earlier of (i) 30 days prior to the deadline for the submission of stockholder nominations for the Company's 2025 annual meeting of stockholders and (ii) 150 days prior to the anniversary of the 2024 Annual Meeting.

Stockholder Recommendations for Director Candidates, and Proxy Access and Universal Proxy Rules

The Nominating and Corporate Governance Committee will consider stockholder suggestions for nominees for directors. Any stockholder who desires to recommend a candidate for director must submit the recommendation in writing and follow the procedures set forth in our by-laws. Our by-laws require that a stockholder’s nomination be received by the corporate secretary

not less than 120 days nor more than 150 days prior to the first anniversary of the date of the preceding year’s annual meeting. The notice should include the following information about the proposed nominee: name, age, business and residence addresses, principal occupation or employment, the number of shares of Company stock owned by the nominee and additional information required by our by-laws as well as any information that may be required by the SEC’s regulations. In addition, the stockholder providing the notice should provide his or her name and address as they appear on our books, the number and type of shares or other equitable interests that are beneficially owned by the stockholder and additional information required by our by-laws. The Committee does not evaluate any candidate for nomination as a director any differently solely because the candidate was recommended by a stockholder. A copy of our by-laws may be obtained by submitting a request to: Advance Auto Parts, Inc., 4200 Six Forks Road, Raleigh, North Carolina 27609, Attention: Corporate Secretary. Our by-laws also are available on our website at ir.advanceautoparts.com under "Governance."

Additionally, our by-laws provide that a stockholder, or group of 20 or fewer stockholders, owning at least three percent of our outstanding shares continuously for at least three years may nominate candidates to serve on the Board and have those candidates included in our annual meeting materials. The maximum number of proxy access candidates that a stockholder or stockholder group may propose as nominees is the greater of (i) two or (ii) 20 percent of the Board. This process is subject to additional eligibility, procedural and disclosure requirements as provided in our by-laws, including the requirements that the nominee must be deemed to be independent under applicable stock exchange listing requirements and that notice of such nominations must be delivered to us neither later than 120 days nor earlier than 150 days prior to the first anniversary of the date on which we mailed the proxy statement for the preceding year’s annual meeting of stockholders.

As specified in our by-laws, if a stockholder intends to comply with the SEC's universal proxy rules and to solicit proxies in support of director nominees other than the Company's nominees, the stockholder must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act not less than 120 days nor more than 150 days prior to the first anniversary of the date of the preceding year's annual meeting.

Board Independence and Structure

Independence

Our Board reviews each director's independence at least annually with the assistance of the Nominating and Corporate Governance Committee and has determined that each of our directors other than Mr. GrecoO'Kelly is “independent” under the listing standards of the New York Stock Exchange (“NYSE”) because each of these individuals:

(1)has no material relationship with us or our subsidiaries, either directly or indirectly, as a partner, stockholder or officer of an organization that has a relationship with us or our subsidiaries; and

(2)satisfies the “bright line independence” criteria set forth in Section 303A.02(b) of the NYSE’s listing standards.

The Board determined that Mr. GrecoO'Kelly is not independent because he is employed as our President and Chief Executive Officer.

In the independence determination, the Board assessed the issue of materiality of any relationship not merely from the standpoint of each director or nominee, but also from that of persons or organizations with which the director or nominee may have an affiliation. Each director is required to keep the Nominating and Corporate Governance Committee fully and promptly informed as to any developments that might affect his or her independence.

Leadership Structure

Our Guidelines on Significant Governance Issues and by-laws allow the Board to combine or separate the roles of the Chair of the Board and the Chief Executive Officer. The Board regularly considers whether to maintain the separation of the roles of Chair and Chief Executive Officer. In the event that the Board chooses to combine these roles, or in the event that the Chair of the Board is not an independent director, our Guidelines on Significant Governance Issues provide for the selection of an independent Lead Director. Mr. Lee currently serves as the independent Chair of the Board. Although the Board believes this structure is appropriate under the present circumstances, the Board has also not adopted a policy on whether the roles of Chairman and Chief Executive Officer should be separated or combined because the Board believes that there is no single best blueprint for structuring Board leadership and that, as circumstances change, the optimal leadership structure may change.

The responsibilities of the independent Chair or independent Lead Director include participating in development of the Board’s agenda, as well as facilitating the discussions and interactions of the Board to ensure that every director's viewpoint is heard and considered. The Chair presides over meetings of the Board and, if independent, also over meetings of the independent directors. When the Chair is not independent, the independent Lead Director is expected to preside over meetings of the independent directors. Where an Independentindependent Lead Director exists, he or she also has the responsibility to act as principal liaison among the Chair, the Chief Executive Officer and the full Board.

Committees and Meetings

Our Board met fourseven times during 20212023 and received periodic written updates from management throughout the year. Each incumbent director attended 75 percent or more of the total number of meetings of the Board and meetings of the committees of the Board on which he or she served during his or her tenure. Our Guidelines on Significant Governance Issues provide that our directors should attend annual meetings of stockholders, and all of our current directors who were serving at the time attended our 20212023 annual meeting of stockholders and were available for questions from our stockholders. In accordance with applicable NYSE listing requirements, our independent directors hold regular executive sessions at which management, including the Chief

Executive Officer, is not present. During 2021,2023, these meetings were presided over by Mr. Lee, our independent Chair of the Board.

We currently have an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee, each of which consists of entirely of independent directors in accordance with the listing standards of the NYSE and whose members satisfy the board committee qualification requirements of the NYSE and SEC.SEC, as well as a Finance Committee, which also consists entirely of independent directors. The following table sets forth the names of each current committee member, the number of times each committee met in 20212023 and the primary responsibilities of each committee. From February 2023 through August 2023, we also had a Succession Committee, composed entirely of independent directors, to lead a search and evaluation of internal and external candidates for Chief Executive Officer.

AUDIT COMMITTEE

| | | | | | | | | | | |

| Members: | | Primary Responsibilities |

John F. Ferraro (Chair) Carla J. Bailo Joan M. Hilson Arthur L. Valdez Jr.

Meetings in 2021: 72023: 11 | | • | monitors the integrity of our financial statements, reporting processes, internal controls and legal and regulatory compliance; |

| • | appoints, determines the compensation of, evaluates and, when appropriate, replaces our independent registered public accounting firm; |

| • | pre-approves all audit and permitted non-audit services to be performed by our independent registered public accounting firm; |

| • | monitors the qualifications and independence and oversees performance of our independent registered public accounting firm; |

| • | reviews, discusses with management and makes recommendations tooversees the Board regarding our financial policies, including investment guidelines, deployment of capitalCompany's information technology, cyberscurity risk and short term and long term financing;privacy exposures; and |

| • | reviews with management the implementation and effectiveness of the Company’s compliance programs, discusses guidelines and policies with respect to risk assessment and risk management and oversees our internal audit function. |

COMPENSATION COMMITTEE | | | | | | | | | | | |

| Members: | | Primary Responsibilities |

Jeffrey J. Jones II (Chair) Douglas A. Pertz Sherice R. Torres Nigel Travis

Meetings in 2021: 62023:10 | | • | reviews and approves our executive compensation philosophy; |

| • | annually reviews and approves corporate goals and objectives relevant to the compensation of the CEO and evaluates the CEO’s performance in light of these goals; |

| • | determines and approves the compensation of our executive officers; |

| • | oversees our incentive and equity based compensation plans, reviews and approves our peer companies and data sources for purposes of evaluating our compensation competitiveness and establishing the appropriate competitive positioning of the levels and mix of compensation elements; |

| • | oversees development and implementation of the succession plans for executive management (other than the CEO), including identifying successors and reporting annually to the Board; |

| • | oversees the Company’s executive compensation recovery (“clawback”) policy; and |

| • | recommends to the Board compensation guidelines for determining the form and amount of compensation for outside directors. |

NOMINATING and CORPORATE GOVERNANCE COMMITTEE | | | | | | | | | | | |

| Members: | | Primary Responsibilities |

Nigel TravisDouglas A. Pertz (Chair)

Carla J. Bailo Jeffrey J. Jones II Douglas A. Pertz

Meetings in 2021: 72023:5 | | • | assists the Board in identifying, evaluating and recommending candidates for election to the Board; |

| • | establishes procedures and provides oversight for evaluating the Board and management; |

| • | oversees development and implementation of the CEO succession plan, including identifying the CEO's successor and reporting annually to the Board; |

| • | develops, recommends and reassesses our corporate governance guidelines; |

| • | reviews and recommends retirement and other policies for directors and recommends to the Board whether to accept or reject a director's resignation; |

| • | reviews the development and communication of our ESGbusiness sustainability programs; |

| • | evaluates the size, structure and composition of the Board and its committees; and |

| • | establishes procedures for stockholders to recommend candidates for nomination as directors and to send communications to the Board. |

FINANCE COMMITTEE | | | | | | | | | | | |

| Members: | | Primary Responsibilities |

Joan M. Hilson (Chair) Eugene I. Lee, Jr. Arthur Valdez Jr.

Meetings in 2023:3 (established May 2023) | | • | reviews and makes recommendations to the Board regarding the Company's financial policies, practices and strategies; |

| • | reviews any significant changes to the Company's capital structure and financing arrangements; |

| • | reviews the financial aspects of any proposed acquisition or divestiture; |

| • | reviews and provides input to management in connection with development of the Company's financial plan; and |

| • | reviews major banking relationships and lines of credit. |

9

Our Board has adopted written charters for each committee setting forth the roles and responsibilities of each committee. Each of the charters is available on our website at ir.advanceautoparts.com under "Governance."

Board’s Role in Risk Oversight

One of our Board’s responsibilities is the oversight of the enterprise-wide risk management activities of the Company. Risk is inherent in any business, and the Board’s oversight, assessment and decisions regarding risks occur in the context of, and in conjunction with, the other activities of the Board and its committees that are comprised solely of non-management directors. As further described below, the Board, directly and through its committees, regularly engages in risk dialogue with management.

Our management retains primary responsibility for identifying risks and risk controls related to significant business activities and mapping those risks to our long termlong-term strategy. On an annual basis, our management executes a comprehensive risk identification and analysis process and reports and discusses its findings with the Board. In addition to the comprehensive annual review, management provides regular updates to the Audit Committee, or as appropriate, the full Board, on risk exposure and mitigation efforts, as well as discusses any recommendations with respect to risk management.

Each committee of the Board is responsible for oversight of areas of risk related to its delegated responsibilities as follows, and each of the committees regularly reports on its discussions and activities to the Board:

•Audit Committee: financial reporting; capital structure and financial policies; independent audit; enterprise risk management process and assessment; Internal Audit; internal controls and compliance (including ethics hotline reporting); cybersecurity and data privacy

•Compensation Committee: compensation programs, policies and practices, including with respect to confirmation that they do not encourage unnecessary or excessive risk taking and the relationship between them and the relationship among our risk management policies and practices

•Nominating and Corporate Governance Committee: corporate governance; director candidate selection; Board and CEO succession; Board evaluation; ESGbusiness sustainability programs; related party transactions and potential conflicts of interest; insider trading; and political and charitable contributions

•Finance Committee: financial risk assessment and management; capital strategies; insurance programs

Board Evaluation

The Board recognizes that a robust and constructive evaluation process is an essential component of good corporate governance and Board effectiveness. Evaluations are designed to assess the qualifications, attributes, skills and experience represented on the Board and whether the Board, its committees and individual directors are functioning effectively.

| | | | | | | | | | | | | | |

| Board Evaluation Objectives

Evaluations are designed to assess the qualifications, attributes, skills and experience represented on the Board and whether the Board, its committees and individual directors are functioning effectively.

|

| | | | |

| Role of the Board The Board is responsible for annually conducting an evaluation of the Board and individual directors. | | | Role of the Board’s Committees The Nominating and Corporate Governance Committee coordinates each Committee's annual evaluation of its performance and reporting of the results to the Board. |

| | | | |

| 20212023 Evaluation Process

The evaluation process included live interviews with each director conducted by an independent third party, who compiled the results and discussed them with the Chair of the Board and the Chair of the Nominating and Corporate Governance Committee. The results of the assessment were then reported to and discussed by the full Board. | | | Topics Addressed in 20212023 Topics addressed in the evaluation process included, among others: the role and functioning of the Board and Board committees; Board oversight of and interaction with management, including recent management transitions; Board composition and refreshment; interpersonal dynamics of the Board and committees; diversity of the Board; qualifications of directors; Board succession; director preparedness; Board interaction with management and management succession; Board committee structure and governance; and representation of stockholder interests. |

Stockholder and Interested Party Communications with our Board

Any interested party, including any stockholder, who desires to communicate with our Board generally or directly with a specific director, one or more of the independent directors, our non-management directors as a group or our Chair of the Board, including on an anonymous or confidential basis, may do so by delivering a written communication to the Board, a specific director, the independent directors, the non-management directors as a group or to our Chair of the Board, c/o Advance Auto Parts, Inc., 4200

Six Forks Road, Raleigh, North Carolina 27609, Attention: General Counsel. The general counsel will not open a communication that is conspicuously marked "Confidential" and is addressed to one or more of our independent directors, our non-management directors as a group or our Chair of the Board and will forward each such communication to the appropriate individual director or group of directors. Such communications will not be disclosed to the non-independent members of our Board or management unless so instructed by the independent or non-management directors.

Code of Ethics and Business Conduct